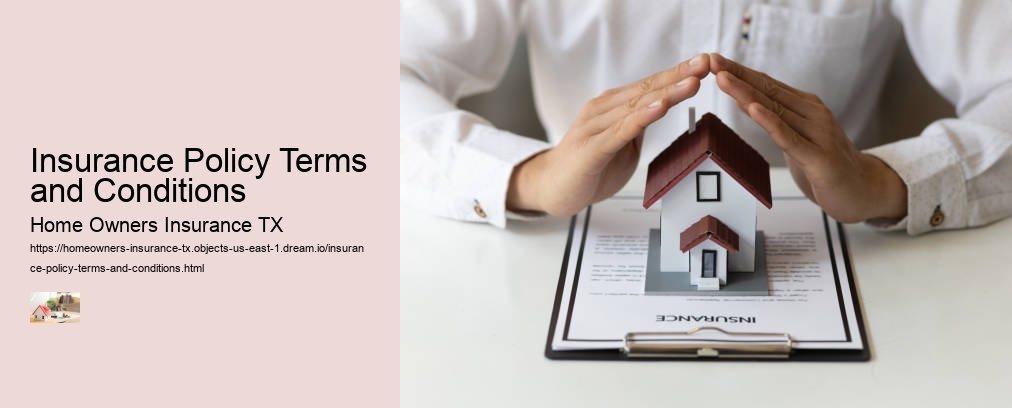

When it comes to understanding your insurance policy, one of the most important things to pay attention to is the coverage details and limitations outlined in the terms and conditions. These are the specific guidelines that dictate what is covered by your policy and what is not.

Coverage details refer to the extent of protection provided by your insurance policy. This includes information on which events or circumstances are covered, as well as any exclusions that may apply. It's crucial to have a clear understanding of what is included in your coverage so that you can make informed decisions about your insurance needs.

On the other hand, limitations outline the restrictions or conditions that may affect your coverage. These can include limits on payouts, restrictions on certain types of claims, or requirements for specific actions in order to be eligible for coverage. By knowing these limitations upfront, you can avoid any surprises when it comes time to file a claim.

Overall, familiarizing yourself with the coverage details and limitations of your insurance policy is essential for ensuring that you have adequate protection in place. Be sure to read through these terms carefully and ask questions if anything is unclear. Your insurance agent or provider should be able to help clarify any aspects of your policy that you may not fully understand. Remember, being informed about your coverage details and limitations is key to making sure you are adequately protected in case of an unexpected event.

When it comes to insurance policies, one important aspect to consider is the premium payment terms and frequency. Premium payments refer to the amount of money that policyholders are required to pay in order to maintain their insurance coverage.

The payment terms typically outline when the premiums are due, whether they can be paid monthly, quarterly, semi-annually, or annually. The payment frequency, on the other hand, refers to how often these payments need to be made.

Insurance companies offer different options for premium payment terms and frequencies to suit the needs and preferences of their policyholders. Some individuals may prefer monthly payments for better budgeting purposes, while others may opt for annual payments for convenience or cost savings.

It is essential for policyholders to carefully review and understand these premium payment terms and frequencies before committing to an insurance policy. Failure to make timely payments could result in a lapse of coverage or even cancellation of the policy altogether.

In conclusion, when considering an insurance policy, it is crucial to take into account the premium payment terms and frequency that best align with your financial situation and preferences. By understanding these aspects upfront, you can ensure that you are able to maintain your coverage without any interruptions.

When it comes to dealing with insurance policies, understanding the claims process and requirements is crucial. The claims process refers to the steps that need to be taken in order to file a claim with your insurance company and receive compensation for covered losses.

In order to successfully navigate the claims process, it is important to carefully review and understand your insurance policy's terms and conditions. These are the specific details outlined in your policy that dictate what is covered, how much coverage you have, and what requirements must be met in order to file a claim.

Some common requirements for filing a claim include providing documentation of the loss or damage, such as receipts, photos, or police reports. You may also need to fill out specific forms provided by your insurance company and meet certain deadlines for submitting your claim.

It is important to follow these requirements closely in order to ensure that your claim is processed quickly and efficiently. Failure to meet the necessary requirements could result in delays or even denial of your claim.

By familiarizing yourself with the claims process and understanding the requirements outlined in your insurance policy's terms and conditions, you can better protect yourself in the event of a loss or damage covered by your policy. Remember, communication with your insurance company is key during this process, so don't hesitate to reach out if you have any questions or concerns.

Policy renewal procedures are an important aspect of insurance policies that every policyholder should be aware of. When your insurance policy is nearing its expiration date, it is crucial to understand the steps and requirements for renewing your coverage.

Typically, insurance companies will send a renewal notice to policyholders in advance of the expiration date. This notice will outline the terms and conditions for renewing your policy, including any changes in coverage or premiums. It is important to carefully review this information and contact your insurer if you have any questions or concerns.

To renew your policy, you may need to provide updated information about yourself or any covered individuals, such as changes in address or contact information. You may also need to pay the renewal premium by a certain deadline to ensure continuous coverage.

Failure to renew your policy on time could result in a lapse in coverage, leaving you unprotected in the event of an accident or loss. To avoid this situation, it is essential to stay informed about your policy's renewal procedures and act promptly when necessary.

By understanding and following the policy renewal procedures outlined by your insurer, you can ensure that your coverage remains up-to-date and provides the protection you need. Remember that insurance is a valuable tool for managing risk, so it is important to take care of your policies responsibly and proactively.

When it comes to understanding insurance policy terms and conditions, one of the key concepts to grasp is that of exclusions and exceptions. These are important clauses in an insurance policy that outline situations or circumstances where coverage may not apply.

Exclusions refer to specific events or conditions that are not covered by the insurance policy. For example, many health insurance policies have exclusions for pre-existing conditions or certain types of medical treatments. It is crucial to carefully review these exclusions to fully understand what is and isn't covered by your policy.

On the other hand, exceptions are situations where coverage may still apply even if it falls under an exclusion. These exceptions can vary depending on the type of insurance policy you have. For instance, some auto insurance policies may have exceptions for accidents caused by uninsured drivers.

Understanding exclusions and exceptions in your insurance policy is essential for making informed decisions about your coverage. It is important to read through your policy carefully and ask questions if you are unsure about any terms or conditions. By being aware of these clauses, you can ensure that you have the right level of protection for your needs.

In conclusion, exclusions and exceptions play a critical role in insurance policies by defining what is and isn't covered under various circumstances. By familiarizing yourself with these terms, you can make sure that you have adequate coverage and avoid any surprises when filing a claim.

The termination of a policy is a crucial aspect of any insurance agreement. It refers to the end of coverage under the policy, whether it be due to non-payment of premiums, expiration of the policy term, or cancellation by either the insurer or the insured.

When a policy is terminated due to non-payment of premiums, it means that the insured has failed to keep up with their financial obligations under the agreement. This can result in loss of coverage and potentially leave them vulnerable in case of an unforeseen event.

On the other hand, policies may also come to an end when they reach their expiration date. In this case, both parties have fulfilled their obligations under the agreement and coverage ceases to exist beyond that point.

Cancellation of a policy can occur for various reasons, such as misrepresentation by the insured or changes in circumstances that make it necessary for the insurer to terminate coverage. It is important for both parties to understand the terms and conditions surrounding policy termination to avoid any confusion or misunderstandings.

In conclusion, understanding when and how a policy can be terminated is essential for all parties involved in an insurance agreement. Clear communication and adherence to terms and conditions are key factors in ensuring a smooth transition when coverage comes to an end.

When it comes to insurance policies, understanding the terms and conditions is crucial. However, disputes can sometimes arise between policyholders and insurance companies regarding these terms. This is where dispute resolution mechanisms come into play.

Dispute resolution mechanisms are processes put in place to help resolve conflicts or disagreements in a fair and efficient manner. These mechanisms can include negotiation, mediation, arbitration, or even litigation if necessary.

Negotiation involves both parties discussing the issue at hand and trying to come to a mutual agreement. Mediation involves a neutral third party helping facilitate communication between the parties to reach a resolution. Arbitration involves both parties presenting their cases to a neutral arbitrator who will make a binding decision. Litigation involves taking the matter to court for a judge or jury to decide.

Having effective dispute resolution mechanisms in place is essential for ensuring that issues regarding insurance policy terms and conditions are handled fairly and promptly. It helps prevent prolonged legal battles and costly court fees, ultimately benefiting both policyholders and insurance companies.

In conclusion, understanding the importance of dispute resolution mechanisms for insurance policies is vital for all parties involved. By having these processes in place, conflicts can be resolved efficiently, allowing policyholders to have peace of mind knowing that their concerns will be addressed fairly.